Getting a handle on inventory

For retailers, manufacturers and many other businesses, a significant amount of working capital is tied up in inventory. What can your company do to lower its inventory carrying costs?

For retailers, manufacturers and many other businesses, a significant amount of working capital is tied up in inventory. What can your company do to lower its inventory carrying costs?

Prospective nonprofit board members commonly cite time constraints as a reason not to join. The same goes for current members who resign. Make it easier for qualified individuals to focus their talents with committee work.

Disaster-relief charities have long contended with sudden influxes of attention and donations. But any nonprofit could face this “problem.” Be sure to prepare for logistical and other challenges.

Construction businesses face a number of distinctive challenges when it comes to financial management. Fortunately, there are also plenty of solutions to be found.

Business owners: Make sure you’re not tossing your financial statements in a file drawer and forgetting about them. They contain valuable info!

You’d be forgiven for ignoring tax breaks contained in the Inflation Reduction Act. After all, they won’t help tax-exempt organizations. Or will they? We suggest you look at two provisions benefitting nonprofits.

Construction companies are increasingly being asked to work on “smart” buildings. These high-tech projects are good opportunities but can be challenging as well. Here are four things to know.

Today, many companies are seeking innovative ways to improve their financial health. One area to focus on, that’s easy to overlook, is billing and collections.

Maintaining a social media presence is a must for nonprofits these days. But you also want your efforts to be effective. Learn how to evaluate platform use and protect your reputation online.

B2B companies typically offer credit arrangements to their customers. If your business does so, be sure your credit assessment process is continuously improving.

Has your nonprofit’s mission shifted in recent years? You may need to make the change official. Here’s how to evaluate your mission, write a new statement and notify invested parties.

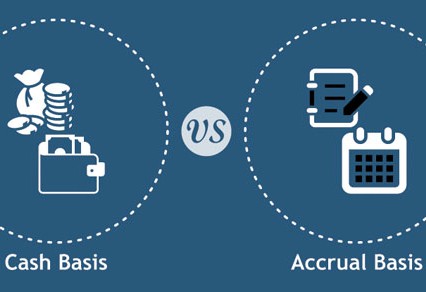

Is your business using the optimal method of accounting? What’s right depends on your company’s size, level of sophistication and other key factors.